Engagement & Retention project | Mudrex

This Engagement and Retention project specifically focuses on Mudrex Futures, rather than the entire Mudrex ecosystem. The goal is to analyze how Futures as a product drives user engagement, activation, and long-term retention. Each strategy, campaign, and insight is tailored to Futures traders, addressing their unique behaviors, pain points, and motivations. This ensures that all solutions proposed are directly aligned with improving Mudrex Futures adoption, trade frequency, and user stickiness.

This Engagement and Retention project specifically focuses on Mudrex Futures, rather than the entire Mudrex ecosystem. The goal is to analyze how Futures as a product drives user engagement, activation, and long-term retention. Each strategy, campaign, and insight is tailored to Futures traders, addressing their unique behaviors, pain points, and motivations. This ensures that all solutions proposed are directly aligned with improving Mudrex Futures adoption, trade frequency, and user stickiness.

About Mudrex

Mudrex is a global cryptocurrency investment platform that simplifies crypto trading and investing for retail users. Established in 2018, Mudrex offers a secure, FIU-registered platform with insured funds, ensuring a safe and seamless trading experience.

What Mudrex Provides

✅ Coins: Trade & invest in 650+ cryptocurrencies

✅ Coin Sets: Diversified theme-based crypto baskets

✅ Futures Trading: 350+ trading pairs with up to 100x leverage

✅ Secure & Compliant: FIU-registered, insured funds, and user-friendly UI

Mudrex empowers users with simple, powerful, and automated investment tools, making crypto accessible to beginners and experienced traders alike. 🚀

Mudrex Futures - A Sneak Peek

Core Value Proposition (CVP)

A core value proposition is the primary advantage a product offers its customers, setting it apart from competitors.

| Feature | Mudrex Futures Offering |

|---|---|

Trading Pairs | 350+ pairs (largest selection in India) |

Trade Signals | Accurate & reliable (Currently on Telegram, not in-app yet) |

INR Deposits/Withdrawals | Seamless INR on/off ramp |

Crypto Withdrawals | Allows wallet-to-wallet transfers (not offered by competitors) |

Simple UI | Beginner-friendly, easy navigation |

Risk Management Tools | Stop-Loss & Take-Profit orders |

User Problem Solved

- Other exchanges offer limited trading pairs, restricting strategy flexibility.

- No crypto withdrawals on many platforms → Mudrex allows Crypto wallet-to-wallet transfers

- Other platforms have no trade signals, while Mudrex provides signals, which is a boon to a lot of newbie traders

Natural Frequency

Natural Frequency refers to how often users interact with the product.

| User Type | Trading Frequency |

|---|---|

Casual Users | 2-3 times per month |

Core Users | 5-6 times per month |

Power Users | Daily or multiple times per day |

Observations

- Casual traders trade only during market volatility.

- Core traders engage more regularly but not daily.

- Power traders hedge positions frequently and use leverage.

- Market trends (price spikes/drops) drive re-engagement.

Engagement Framework

The engagement framework is built on three pillars:

| Engagement Type | Definition | Current Status at Mudrex | Should this be a priority? |

|---|---|---|---|

Breadth | How many different features a user engages with. | Limited (Only trading pairs & order types) | Yes, expanding features will help |

Depth | How intensely a user engages with the platform. | Manual trading, no automation or insights | Yes, depth needs enhancement |

Frequency | How often users interact with the product. | Mostly triggered by market movements & push notifications | Already strong but can be optimized |

Insights & What Works for Mudrex

- Breadth needs improvement → No rewards, leaderboard, or analytics currently available.

- Depth is moderate → Users rely on manual trading & risk management tools, but no automation.

- Frequency is event-driven → Market trends & push notifications work well, but additional retention strategies could improve engagement.

Who is an Active User?

An active user is someone who has truly experienced the core value proposition.

| Criteria | Definition for Mudrex Futures |

|---|---|

What action defines an active user? | Placing at least X trades in Y time frame (Say 3 trades in 7 days) |

Does one trade count as active? | No, first-time, one-trade users are not active. |

Do Stop-Loss & Take-Profit users count? | Yes, but they are engaged users, not necessarily active. |

Does Spot-to-Futures transfer count? | No, because 38% of these users never trade. |

Insights

- A one-time trader is not an active user → They must return for multiple sessions.

- Stop-Loss/Take-Profit users are engaged, but not necessarily fully active.

- Placing a trade is the primary activation metric.

Summary

| Category | Findings |

|---|---|

Core Value | Largest selection of trading pairs, INR deposits, simple UI. |

Natural Frequency | Casual (2-3x/month), Core (5-6x/month), Power (daily) |

Breadth of Engagement | Limited (no additional features beyond trading). Needs improvement. |

Depth of Engagement | Manual trading, no automation. Could improve with more analytics. |

Frequency of Engagement | Driven by market trends & push notifications. Works well. |

Active User Definition | Must place X trades in Y time frame. Stop-Loss users are engaged, but not necessarily active. |

Why Segment Users?

Segmenting users helps us understand different behavior patterns, improve retention strategies, and tailor engagement efforts based on specific needs.

Goal of Segmentation for Mudrex Futures

- Identify user groups based on engagement, revenue, and behavior.

- Optimize retention strategies for each segment.

- Personalize nudges and features to maximize trading activity.

ICP-Based Segmentation

| Parameter | ICP 1: Beginner Trader | ICP 2: Pro Trader |

|---|---|---|

Trading Experience | New to Futures, exploring with small amounts. | Experienced trader, seeks leverage & high-volume trading. |

Social Media | Instagram, YouTube (watches trading tutorials), Telegram groups. | Twitter (Crypto Twitter), TradingView, Telegram (premium trading groups). |

City | Tier 1 & Tier 2 cities (Bangalore, Mumbai, Pune, Hyderabad, Delhi, Kolkata, Indore, Ahmedabad). | Tier 1 & Tier 2 cities (Mumbai, Delhi, Bangalore, Pune, Chennai, Hyderabad). |

Languages Spoken | English, Hindi, regional languages (Tamil, Telugu, Marathi, Gujarati, Bengali). | English, Hindi (more comfortable with trading terminology in English). |

Age Group | 22-35 (early career, young professionals, students exploring trading). | 28-45 (working professionals, finance enthusiasts, full-time traders). |

Employment | Working professionals, freelancers, students, side hustlers. | Entrepreneurs, high-income professionals, full-time traders, investors. |

Pain Points | - Complex UI/UX, difficult onboarding. - Fear of liquidation, lack of knowledge. - Unsure about leverage & risk management. - Hard to find simple explanations for Futures trading. | - High fees cutting into profits. - Missing automation tools. - No access to portfolio analytics. - Execution speed concerns. |

Who They Follow | - YouTube trading influencers (Pushpendra Singh, Kashif Raza, Rekt Capital). - Twitter accounts explaining basics of crypto. - Instagram pages posting crypto memes & simplified content. | - Top crypto traders on Twitter (Pentoshi, Ansem, Cobie). - Market analysts & macroeconomic experts. - Telegram premium trading channels. |

What Do They Watch/Read? | - YouTube tutorials on crypto & technical analysis. - Instagram reels about "how to make passive income". - News on Economic Times & Moneycontrol. | - Twitter threads about global markets. - Research reports from Binance, CoinGecko, Messari. - Economic Times, Forbes India, TradingView analyses. |

Relationship Status | Mostly single, some married. | Mostly married, some single. |

Influencers They Trust | - Anupam Gupta (finance content). - Indian crypto influencers breaking down complex concepts. | - Global traders like Pentoshi, TheCryptoDog. - Macro finance influencers like Raoul Pal, Arthur Hayes. |

Other Platforms They Use | WazirX, CoinDCX, CoinSwitch (spot traders moving to Futures). | Binance, Bybit (previously), Delta Exchange, TradingView, KuCoin. |

Time Spent on Researching | 30-60 minutes per week (casual learning). | 2-3 hours per day (studying charts, reading reports). |

Willingness to Spend on Learning | Low – Prefers free resources like YouTube & Twitter. | High – Pays for Telegram signals, TradingView premium, paid research reports. |

Spending Capacity | ₹10K-₹50K per trade, occasional trader. | ₹1L-₹50L+ per trade, high-volume trader. |

Most Used Features | - BTC/ETH trading pairs. - Basic market & limit orders. - Stop-Loss & Take-Profit tools. - Trade signals (Telegram). | - High-leverage trades. - Multi-pair trading. - Manual hedging strategies. - Needs analytics & tracking tools. |

Frequency of Usage | 2-3 trades per month. | 10+ trades per week. |

What Else Do They Invest In? | Stocks, fixed deposits, gold ETFs, mutual funds. | Real estate, NFTs, early-stage crypto projects, private equity. |

User Interview Questions for Each ICP

ICP 1: Beginner Trader

1️⃣ What made you interested in Futures trading?

2️⃣ What are your biggest fears about trading Futures?

3️⃣ How do you usually research before placing a trade?

4️⃣ What’s the hardest part of understanding leverage?

5️⃣ Which influencers, YouTube channels, or blogs do you trust for trading knowledge?

6️⃣ What do you find confusing about the Mudrex Futures interface?

7️⃣ Have you faced any issues withdrawing or depositing funds?

8️⃣ How many trades do you place per month? What factors influence this?

9️⃣ Do you set Stop-Loss/Take-Profit orders, or do you trade manually?

🔟 What would make you more confident in trading Futures regularly?

ICP 2: Pro Trader

1️⃣ How do you decide which Futures platform to trade on?

2️⃣ What do you like/dislike about Mudrex compared to Binance/ Bybit?

3️⃣ How much does execution speed & fees impact your strategy?

4️⃣ Do you use any automation tools? If yes, what do you need in an ideal trading platform?

5️⃣ What analytics tools do you use to track your trading performance?

6️⃣ How do you hedge your trades? Do you use Spot & Futures together?

7️⃣ What trading pairs do you focus on? Do you explore new pairs?

8️⃣ How much do withdrawal speeds impact your choice of platform?

9️⃣ Have you ever switched platforms? If yes, what made you leave?

🔟 If you could change one thing about Mudrex Futures, what would it be?

Summary of ICP Analysis

| ICP Segment | Engagement Goal | Retention Strategy |

|---|---|---|

Beginner Traders | Convert them from first-time traders to repeat traders. | -Improve onboarding experience. -Provide simplified educational content. -Make UI/UX more intuitive. |

Pro Traders | Increase trading volume & long-term loyalty. | -Lower fees & improve execution speed. -Introduce pro analytics & automation tools. -Offer exclusive benefits for high-volume traders. |

User Segmentation Model

Users can be segmented based on various criteria:

| Segmentation Type | Definition for Mudrex Futures |

|---|---|

Power/Core/Casual | Based on trading frequency & volume. |

ICP/Persona-Based | Ideal Customer Profiles based on needs & behavior. |

Natural Frequency | How often users naturally trade. |

Revenue-Based | Categorized by trading volume & fees generated. |

Feature Usage-Based | Analyzing use of order types, signals, etc. |

Advanced Segmentation | Identifying Loyalists, At-Risk, Hibernating Users. |

Power/ Core/ Casual Segmentation

| User Type | Usage Characteristics | Trading Volume (Weekly Median) | Pain Points | Valued Features |

|---|---|---|---|---|

Casual Users | Trade occasionally, during volatile markets. | <10K | Unclear onboarding, UI bugs, high fees. | Simple UI, easy deposits, BTC/ETH pairs. |

Core Users | Trade regularly but not daily. | 10K - 100K | Limited analytics, missing advanced trading tools. | Multiple trading pairs, reliable execution. |

Power Users | Trade frequently, hedge positions, use leverage. | 100K+ | High fees, UI/UX issues, need for automation tools. | Fast execution, deep liquidity, advanced risk tools. |

Key Takeaways

- Casual users need education & better onboarding.

- Core users need deeper analytics & more trading pairs.

- Power users need fee reductions & advanced tools.

Advanced Segmentation: Identifying Loyalty & Churn Risks

| User Type | Definition | Retention Strategy |

|---|---|---|

Loyalists | High-frequency traders with good retention. | Offer VIP perks, rewards, & personalized support. |

Champions | Recently joined but highly engaged. | Provide exclusive insights & advanced tools. |

At-Risk Users | Engaged before but activity is declining. | Use personalized nudges, fee discounts, & re-engagement emails. |

Hibernating Users | Stopped trading for a long time. | Reactivation campaigns & incentives to return. |

Key Takeaways

Loyal users should be rewarded → Exclusive features & better support.

At-risk & hibernating users need intervention → Targeted campaigns & fee discounts.

Summary

| Segmentation Type | Findings |

|---|---|

Power/Core/Casual | Casual traders need better onboarding, power users need advanced tools. |

ICP-Based | Beginners need education, pro traders need better execution & fee structures. |

Feature-Based | Users mostly engage with basic trading; analytics & automation are missing. |

Advanced Segmentation | Identified Loyalists, At-Risk, & Hibernating users for targeted engagement. |

Why RFM is Not Applicable to Mudrex Futures?

Here, RFM framework is not attempted. RFM segmentation is ideal for mature products with predictable user retention, but Mudrex Futures is in early scaling, where engagement patterns are still evolving. Since Futures trading is highly market-dependent, users don't follow fixed recency or frequency behaviors. Instead, we focus on engagement-based segmentation (Casual, Core, Power Users) to drive activation, retention, and growth.

But for reference purpose, attaching a current RFM segmentation derived from Clevertap for Future

Product Hook

A product hook is designed to retain users, improve activation, and increase trade frequency. Given Mudrex Futures' current strengths and challenges, the key hooks focus on reducing friction, incentivizing engagement, and improving trader confidence.

Product Hook Framework for Mudrex Futures

| Section | Details |

|---|---|

🎯 Goal | Increase retention (Primary) → Ensure users return and trade consistently. Improve activation (Secondary) → Encourage first-time users to place multiple trades. Enhance trade frequency → Incentivize repeated engagement with Mudrex Futures. |

📈 Success Metrics | 🔹 Growth in weekly active traders (WAU) 🔹 Increase in trades per user per week 🔹 Higher retention rate (users returning after first trade) 🔹 Reduction in first-time drop-off rate |

⚠️ Problem Statement | Users drop off after their first trade due to complexity, lack of in-app trade signals,high flat fees, and missing advanced tools (e.g., copy trading). There is no compelling hook to make them return and continue trading. |

🔄 Current Alternative | 🔹Trade signals exist but only on Telegram → No direct in-app integration. 🔹High flat fee (0.1%) → No incentive for volume-based trading. 🔹Manual trading only → No copy trading or automation to simplify decision-making. |

✅ Solution (Summary) | Introduce three product hooks to improve retention & engagement: 1️⃣ In-App Trade Signals → Moving trade signals from Telegram into the app 2️⃣ Copy Trading → Allowing users to follow expert traders' strategies in one click. 3️⃣ Tiered Fee Structure → Rewarding high-volume traders with lower fees instead of a flat 0.1% fee. |

🔍 Solution (Detailed Version & User Flow) | User Flow for In-App Trade Signals & Copy Trading: 1️⃣ User logs into Mudrex & lands on the Futures dashboard. 2️⃣ Sees trade signals in-app (instead of checking Telegram). 3️⃣ Clicks on a trade signal & either places a manual trade OR follows a top trader via Copy Trading. 4️⃣ Engages in volume-based fee reduction → The more they trade, the lower the fee. 5️⃣ User receives a push notification when a new trade signal is available |

📊 Metrics to Track | 🔹 % of users interacting with in-app trade signals 🔹Conversion rate of users adopting copy trading 🔹 % of high-volume traders shifting to lower fee tiers 🔹 Increase in retention after first trade |

🚀 Ramp-Up Milestones | 1️⃣ Phase 1 (Beta Release): Launch in-app trade signals to selected power users. 2️⃣ Phase 2: Open copy trading to high-volume traders. 3️⃣ Phase 3: Introduce tiered fee structure with volume-based discounts. 4️⃣ Full Rollout: Expand to all users, supported with engagement campaigns. |

Solutions (Detailed Version & User Flow)

Engagement Campaigns for Mudrex Futures

Since the engagement campaigns should supplement the product hooks, they will focus on:

- In-App Trade Signals (To increase adoption & retention)

- Copy Trading (To improve activation & frequency)

- Tiered Fee Structure (To incentivize high-volume traders)

Each campaign will drive engagement for one of these hooks to ensure users are retained and trade more frequently.

| Campaign | Product Hook | User Segment | Goal | Pitch/Content | Offer | Frequency & Timing | Success Metrics |

|---|---|---|---|---|---|---|---|

1. Trade Signals Onboarding Challenge | In-App Trade Signals | Casual & Core Users | Drive adoption of in-app trade signals & improve first-time trading experience | "📊 Your first 3 winning trades – on us! Follow in-app trade signals & place 3 trades to win a bonus!" | $5 bonus for 3 trades using in-app signals | Onboarding journey: First 7 days post-signup (Push + Email) | % of new users placing a trade via in-app signals |

2. Copy & Earn: Leaderboard Challenge | Copy Trading | Core & Power Users | Encourage users to try copy trading & reward high-performing traders | "🏆 Top 10 traders with the most successful copied trades will win fee waivers & cash rewards! " | Fee-free trading for leaderboard winners | Weekly leaderboard updates (Push + Telegram + In-App Banner) | Increase in copy trading adoption & trade frequency |

3. Copy Trading Referral Bonus | Copy Trading | Casual & New Users | Drive activation & referrals for copy trading | "🚀 Invite a friend to Copy Trading & both get $10 when they place their first copied trade! " | $10 for both referrer & referee | One-time for each referral (WhatsApp + Push Notifications) | Increase in copy trading adoption via referrals |

4. Volume-Based Fee Discount Race | Tiered Fee Structure | Power Users | Incentivize higher trading volume by lowering fees dynamically | "🔻 Your fees can go as low as 0.03%! Trade more, pay less – enter the volume-based fee race now!" | Dynamic fee reduction based on trading volume | Monthly event (Push + Telegram + Email) | Increase in high-volume trading & retention of power users |

5. Exclusive Beta Access: Advanced Trade Signals | In-App Trade Signals | Core & Power Users | Encourage engagement with in-app signals & gamify adoption | "🔮 Be the first to test Advanced Trade Signals! Get VIP early access & influence the next trading feature. " | Beta tester perks (lower fees, exclusive signals) | Invite-only push + email campaign (rolling beta access) | Adoption rate of advanced in-app signals |

Summary of Engagement Strategy

✅ In-App Trade Signals → Trade Signals Challenge & Beta Access (Driving adoption & engagement)

✅ Copy Trading → Leaderboard Challenge & Referral Bonus (Increasing activation & trade frequency)

✅ Tiered Fee Structure → Fee Discount Race (Boosting volume-based trading & loyalty)

Retention Design For Mudrex Futures

The Retention data has been added from Amplitude which has retention curve to analyze user drop-offs over the past 24 weeks. Additionally, I am including a Week-on-Week (WoW) retention chart from Metabase, which helps in identifying weekly cohort retention trends. The retention curve visualization gives a broader view of long-term user engagement, while the week-on-week cohort analysis provides granular insights into how different user batches are retained over successive weeks. Along with these visuals, I have added a detailed analysis of the retention trends, key drop-off points, and cohort behavior, helping to identify where retention efforts should be focused.

Retention Curve Analysis

🔹 Weekly Retention Trend (Last 24 Weeks)

- Severe drop in retention after Week 1 .

- Gradual decline in following weeks, reaching single-digit retention by Week 6-8.

- Retention flattens out after Week 12, indicating that most users who stay beyond this point continue trading.

🔹 Key Drop-off Points:

- Week 1: Biggest drop (retention falls by ~64%).

- Week 4-6: Continuous decline (~below 10% retention).

- Week 12 onward: Flat retention (~3-5%), meaning this is the baseline engaged user segment.

🔹 Focus Intervals for Retention Analysis:

- Week 1 → Critical onboarding retention phase.

- Week 4 → Identifying mid-term engagement drop-off.

- Week 12+ → Stabilized retention segment.

Week-on-Week Retention Analysis (Cohort Retention Trends) from Metabase

The week-on-week retention data provides insights into how different user cohorts behave over time. Based on the heatmap and retention curve, here are the key observations:

Retention Trends & Insights

| Key Observation | Insight from Data | Possible Cause |

|---|---|---|

Steep Week 1 Drop-Off | Retention drops 50-70% after Week 1 across all cohorts. | Users are not engaging beyond the first trade, onboarding friction, or unclear product value. |

Gradual Decline in Weeks 2-5 | Retention stabilizes around 5-15% by Week 5. | Users lose interest due to high fees, lack of advanced features, or UI issues. |

Recent Cohorts Churn Faster | February cohorts drop to near 0% by Week 6, much faster than earlier cohorts. | Activation process worsening, or new users face more friction. |

Some Cohorts Perform Better | January 10 & January 24 cohorts have higher retention (45-48% Week 2). | Possibly better acquisition sources (live streams, SEO, referrals) or improved onboarding experience. |

Actionable Takeaways

| Retention Issue | Fix/Next Steps |

|---|---|

Week 1 drop-off is too high | Improve onboarding flow with guided first trade experience & incentives. |

Retention declines fast in Weeks 2-5 | Add engagement nudges like in-app signals, copy trading, & fee discounts. |

Recent cohorts are churning faster | Investigate what changed in onboarding & acquisition channels recently. |

Certain cohorts retain better | Analyze what worked for January 10 & January 24 cohorts and replicate. |

Churn Analysis: Why Users Leave?

| Churn Type | Key Drivers | Examples |

|---|---|---|

🛑 Voluntary Churn (User chooses to leave) | 🔹High Fees (0.1% flat rate) 🔹Lack of Advanced Features (No AMR, Partial Booking, Hedging, Cross Trading) 🔹Bad Support Experience (Slow responses, unresolved tickets) | "Fees are too high compared to competitors." "I need features like copy trading & automation." |

⚠️ Involuntary Churn (User forced to leave) | 🔹Product Bugs & UI Issues (Confusing Spot to Futures Wallet transfer, platform glitches) 🔹 Payment & Verification Issues (Delayed deposits/withdrawals) | "The app is too buggy, orders don’t execute properly." "My deposit took too long, so I left." |

Negative Actions to Track Before Churn

| Negative Indicator | Available Data? | Insights |

|---|---|---|

Low NPS (Net Promoter Score) | ❌ No NPS data available | Need to implement |

Support Ticket Volume | ✅ Available | Users report bugs, fees, and support issues before churning. |

CSAT (Customer Satisfaction Score) | ✅ Available (Below 30%) | Major dissatisfaction with support resolution. |

Trading Activity Drop-off | ✅ Retention curve data | Steep decline in trading after Week 1. |

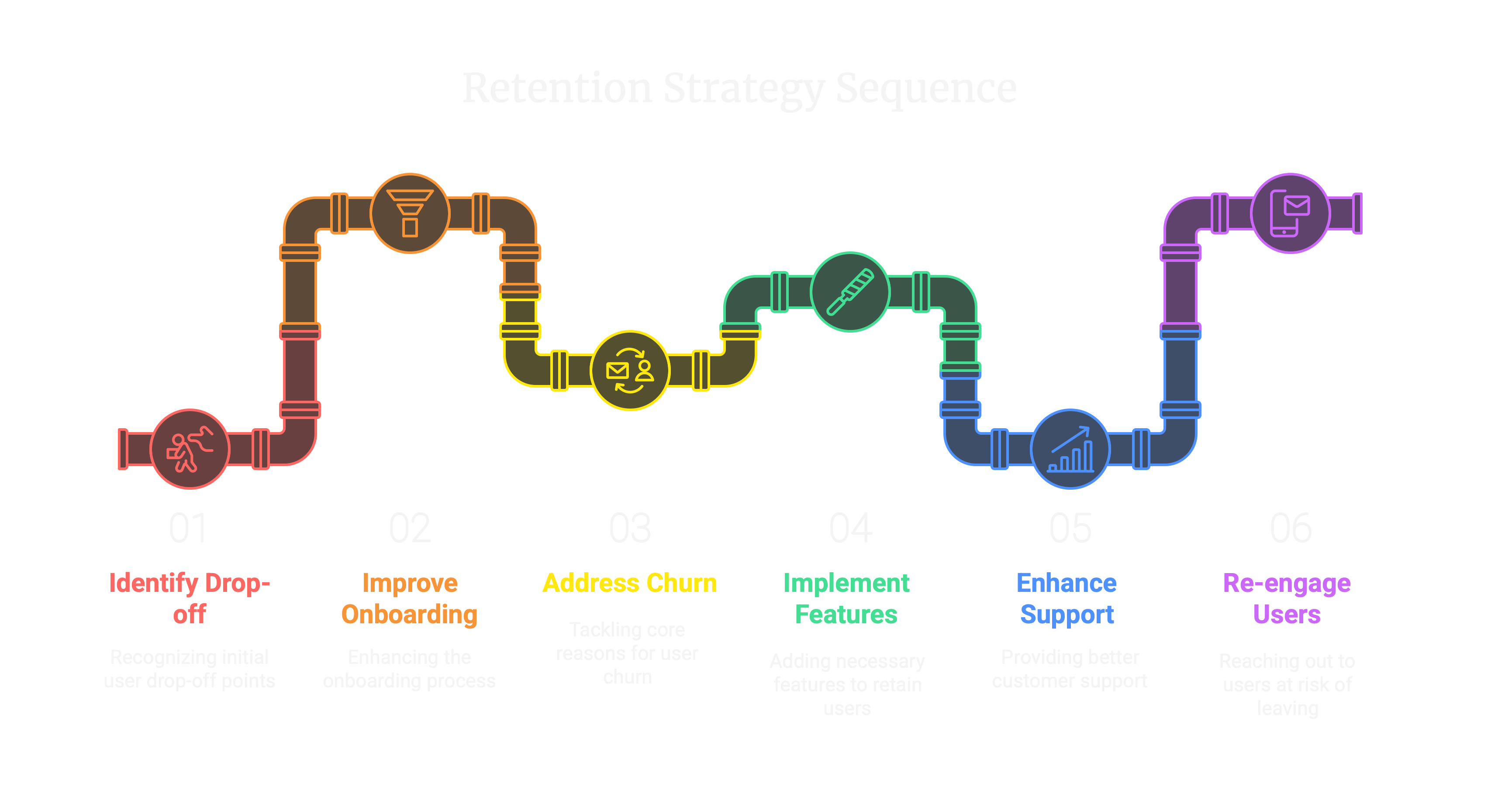

Retention Strategy: How to Fix It?

1️⃣ Reduce First-Week Drop-off → Improve onboarding & first-trade experience.

2️⃣ Address Core Churn Reasons → Lower fees, add missing features, enhance support.

3️⃣ Re-engage Users at Risk → Use product hooks like trade signals & fee discounts.

Resurrection Campaigns for Churned Users

These campaigns are designed to win back churned users by addressing their specific reasons for leaving. Based on voluntary and involuntary churn reasons, we’ve curated campaigns that target fee-sensitive users, those who left due to missing features, trading friction, and users who faced bugs.

Resurrection Campaigns Overview

| Campaign Name | Target User Segment | Churn Type | Pitch/Content | Offer/Incentive | Frequency & Timing | Success Metrics |

|---|---|---|---|---|---|---|

"Welcome Back" First Trade Bonus | Users who tried Futures but never returned after Week 1 | 🛑 Voluntary Churn | "Come back & place your next trade – we’ll cover the fees!" | ✅ $10 first trade bonus | 📅 Triggered 7 days after inactivity | 📈 % of returning traders |

"Trade Without Fees" Limited-Time Offer | Users who stopped trading due to high fees | 🛑 Voluntary Churn | "We’ve slashed fees for a limited time – zero fees on your next trade!" | ✅ Zero fees for 7 days | 📅 Triggered at Week 4 churn | 📈 # of reactivated traders |

"Your Trading Signals Await" | Users who engaged with Telegram trade signals but never placed trades | 🛑 Voluntary Churn | "Your premium trading signals are ready – make your next profitable move!" | ✅ Exclusive access to pro trade signals | 📅 Triggered based on inactivity in trading after signal engagement | 📈 % of users placing a trade |

"Futures V2 is Here – Trade Smarter" | Users who left due to missing features or UI friction | ⚠️ Involuntary Churn | "The all-new Mudrex Futures V2 is here! A smoother smarter and better trading experience with priority support & new tools!" | ✅ Exclusive early access to V2 + priority support | 📅 Triggered at Week 6 churn | 📈 # of traders adopting Futures V2 |

"We Fixed It – Get Back to Trading" | Users who left after facing bugs or platform issues | ⚠️ Involuntary Churn | "We’ve heard you! Bugs are fixed, the app is smoother than ever – your seamless trading experience awaits!" | ✅ Beta access to improved UI + priority bug resolution support | 📅 Triggered at Week 2-4 churn for users who submitted support tickets | 📈 Re-engagement rate & CSAT score improvement |

Resurrection Strategy Focus Areas

- Align campaigns directly to churn drivers (fees, missing features, friction, bugs).

- Personalized outreach via Push, WhatsApp, Email, and In-App Nudges.

- Re-engage users with strong CTAs linked to new experiences (V2 launch, signals, bonuses).

- Measure success via reactivation rates, bug-related support resolution rates & trading volume boost.

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Abhishek

GrowthX

Udayan

GrowthX

Members Only

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Swati Mohan

Ex-CMO | Netflix India

Members Only

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Nishchal Dua

VP Marketing | inFeedo AI

Members Only

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Abhishek Patil

Co-founder | GrowthX

Members Only

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Udayan Walvekar

Co-founder | GrowthX

Members Only

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Tanmay Nagori

Head of Analytics | Tide

Members Only

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

GrowthX

Free Access

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Ashutosh Cheulkar

Product Growth | Jisr

Members Only

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Jagan B

Product Leader | Razorpay

Members Only

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.